Do You Really Need to Store your Paystubs? Let’s Find Out

It is not infrequent for an employee to receive incorrect payment in their account and then struggle to get it fixed. Every year, it happens to numerous professionals around the world. Yet, several people continue to treat paystubs with little importance and even toss them after a cursory glance.

Paystubs are complete records of your payment and deserve space in your financial closet – for a potentially long time. In this article, let us discuss why it is significant to stock your paystubs. We will also understand for how long you should keep these records with you. Arming yourself with this information will protect you at critical junctures in life, such as getting loans approved for your vehicle and proving your standing at a new job.

Why it is Crucial to Save Paystubs

Whether you use an online paystub generator or receive physical payment records, the proper safekeeping of these documents is paramount. Here are the most important reasons to store your payment stubs methodically during a financial year:

1. To understand all about your payments

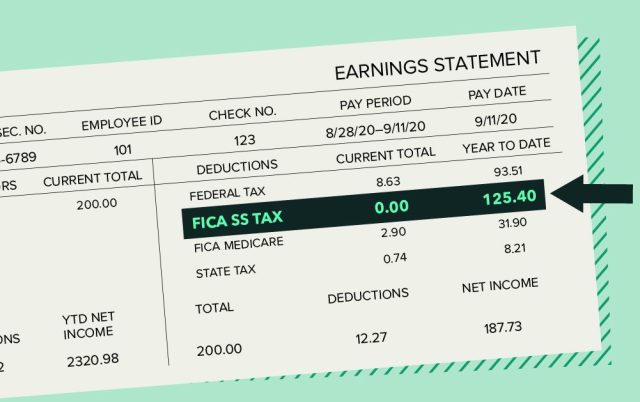

A paystub includes detailed information about the money you make in a pay period. You can check your gross pay, the deductions (towards taxes, insurance, and other policies), and the net cash you bring home. Getting the whole picture lets you plan your finances strategically.

2. To file taxes accurately

Paystubs make it straightforward to file your taxes at the end of the year. You have written records of the payments you have received, along with the deductions for which you are eligible. Completing your tax returns becomes swift and error-free. It is why W-2 forms and paystubs virtually go hand in hand.

3. To share legal proof of your income

You will require a proof of income in multiple situations like applying for a loan, credit card, or a new job. Your paystub is a legally accepted document that satisfies this requirement. You will also need it while claiming medical insurance benefits or purchasing a house. If you don’t receive payment records from your employer/client, you can generate them yourself using a free check stub maker. At StubCheck.com, you can enter a few details regarding your payment information and get professional records within minutes.

While every working individual gets advised to save their paystub, it is even more important for self-employed professionals. Freelancers, for example, may struggle to show their proof of income over a year. Their earnings may vary and get spread across multiple clients. Creating and saving checkstubs for every pay period in a year keeps things well-documented.

4. To guarantee compliance for your business

Business owners need to store paystubs for their entire employee base. It is essential for filing taxes accurately. You will save precious time that would otherwise get wasted in sorting out payment details for full-time employees and consultants. Keeping records ascertains that you comply with the law. You can refer to these financial documents if you face an audit or a regulatory investigation.

If you have a small business, you may lack the necessary funds to hire a full-time payroll staff or personal accountant. It becomes even more vital for you to store all the paystubs you issue during the year.

5. To rectify incorrect payment

Your paystubs reflect your complete payment information, including gross pay, net pay, deductions and exemptions. Sometimes, despite caution by your employer or customer, mistakes might creep into the payment process. If the money deposited in your account does not match the promised amount, you can quickly rectify it by showing your paystub. If you do not store this document, it becomes bothersome to sort out monetary issues. It is more so if you are self-employed or work for multiple clients with different pay periods/cycles.

CREATE A PAYSTUB

For How Long Must I Store Paystubs?

Well, realistically speaking, you cannot let all your paystubs accumulate for months and months and clutter up your home or office. The standard advice for employees is to store paystubs for at least one year or until they get the new W-2 form. The recommendation is different for employers: the Fair Labor Standards Act (FLSA) mandates that companies keep payroll documents for a minimum of three years.

After the stipulated time, you can dispose of the old paystubs. It is important to shred them as opposed to just throwing them in the trash. Paystubs contain crucial, identifying information that can be dangerous in the hands of an unauthorized person.

If you make a paystub online and use digital records for yourself or your team, disposing of them is not necessary. You can store them safely on your computer for a potentially long time without feeling cluttered. If you choose, you can set a delete date for old records. You can finish the virtual shredding process within seconds.

Now that you know how crucial paystubs are, you can forget about tossing them for a good, long time. Also, if you don’t already tally your income with your payslip, now is the time to begin.