How Paycheck Taxes Are Calculated: A Simple Guide

All working people must be aware of how their paychecks and salary are taxed. What are the paycheck taxes? What components are there in them? And how do these all affect the take-home salary? Well, in this reading guide, all these components will be discussed by breaking apart paycheck taxes-how they are calculated and things that need to be known for effective finance management.

Components of Paycheck Taxes

Government collects this portion of tax from every employee, which comprises several components that will be calculated differently. For example, paycheck taxation is classification as Federal Income Tax State Income Tax Social Security Tax Medicare Tax. Local Taxes (if any). Your employer holds those taxes for the government at the right agencies.

How Federal Income Tax is Calculated

Federal income tax is calculated from your taxable income depending on the tax brackets of the IRS. The U.S. has a progressive tax system so that higher-income groups are taxed at higher rates as follows:

- Tax brackets: for the year, IRS taxes an annual tax bracket. For instance, in the year 2025, the range of tax rates is between 10 and 37 percent.

- Marginal tax rate: Your earnings get taxed on tier levels, for example, the first 10,000 at 10 percent, the next 10,000 at 12, and so forth.

- W-4 form: When you start your job, you fill up a W-4 form declaring your filing status (single, married, etc.) and allowances. This helps the employer to determine the federal tax under that withholding.

Federal State and Local Taxes134

There is a lot of difference in the income tax rates by states. A few states like Texas and Florida free from state income tax, while California and New York are examples of states that charge high rates. Here’s the following to know into:

- State Tax Brackets: Nearly like with federal taxes, many states use progressive tax systems.

- Local Taxes: Taxes can also be imposed by cities and counties. For example, in New York City, there is a local income tax in addition to state taxes.

Social Security and Medicare Taxes

Social Security and Medicare taxes are called FICA (Federal Insurance Contributions Act). Here is how they are computed:

- Social Security Tax- 6.2 percent of your gross income but up to a wage base limit ($160,200 in 2023). Your employer contributes an additional 6.2 percent.

- Medicare Tax- 1.45 percent of your gross income with no wage limit; high earners (above $200,000) pay an additional 0.9 percent.

Pre-Tax Deductions and What They Do to You

Pre-tax deductions lower income tax, so that less tax is paid. Some commonly identified pre-tax deductions include:

- Retirement contributions-with a qualified 401(k) or IRA; your money goes in before the calculation of taxes.

- Health Insurance Premiums-paid for employer-based health insurance are typically pre-tax.

- Other Benefits: Flexible Spending Accounts (FSAs) or commuter benefits may also be pre-tax.

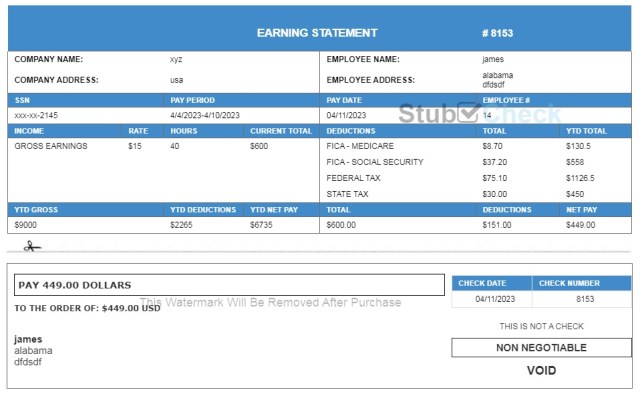

Net Pay versus Gross Pay

- Gross Pay: Total earnings prior to any deductions.

- Net Pay: Take-home amount post-taxation and deductions. Example: If the gross pay of an employee is $3,000 and $500 is deducted for taxes and benefits, the net pay will be $2,500.

Calculating Paycheck Taxes

Online calculators are available for estimation of paycheck taxes. The calculator takes the gross amount, filing status, and deductions as input and pops out the estimated net earning. Always check your paystubs to see that everything is correct, is advised.

Common Mistakes to Avoid

- Incorrect W-4 Filing: Filling out your W-4 incorrectly could lead to too much or too little withholding.

- Not Accounting for Bonuses or Overtime: Supplemental income tends to be taxed at a higher rate, something that could catch some employees by surprise.

- Neglecting Pay Stubs: Regularly reviewing your pay stubs helps you identify errors early on.

Conclusion

Your understanding of paycheck taxes will facilitate sound financial decision-making. Knowing what goes into your paycheck tax, using calculators for estimating your take-home pay, and avoiding common mistakes will help in getting financial management on your side. Make it a point to follow tax law changes, and if in doubt, consult a tax professional for confirmation.

FAQ’s

-

What are paycheck taxes?

Paycheck taxes are deductions taken from your gross income by your employer to pay federal, state, and local taxes, as well as contribution to social security and medicare. These taxes fund various government programs and services.

-

What taxes are deducted from my paycheck?

The main taxes that get deducted from your paycheck are:

- Federal Income Tax

- State Income Tax (if applicable)

- Social Security Tax

- Medicare Tax

- Local Taxes (in certain areas)

-

How is the federal tax calculated?

Federal income tax is calculated based on taxable income and IRS tax brackets. Based on your W-4 form (filing status and allowances), your employer determines how much to withhold.

-

What is the difference between gross pay and net pay?

- Gross Pay: The total amount earned by you before any tax or deductions.

- Net Pay: The amount that goes in your pocket after all taxes and deductions have been removed.

-

What will state taxes do to my paycheck?

State taxes depend on locations. Some states have no income tax; others levy a flat rate, progressive tax rate, or somewhere in between. State withholding is done by your employer according to your state’s rules and the information you gave on your W-4.

-

What are the social security and medicare taxes?

- Social Security Tax: Tax applied on wages at the rate of 6.2% with respect to earnings up to the Wage Base limit of $160,200 (in 2023).

- Medicare Tax: Tax applied on wages of 1.45% without a wage base limit by which high-income earners incur an additional 0.9% tax.

-

What are the pre-tax deductions?

Pre-tax deductions lessen your taxable income before your actual taxes are figured. Some of these deductions may include:

- Retirement contributions (401k, IRA)

- Health insurance premiums

- Flexible spending accounts (FSAs)