Should You Process Payroll In-House or Outsource It? 6 Pros & Cons

Payroll processing is a crucial business task that must be performed with great attention. Erroneous calculations can lead to tax mistakes—something that can cost a company its reputation in audits. You may choose to build a check stub free or subscribe to expensive software—what matters is timely, professional work. In the modern business landscape, you have two options: 1, to handle finances on your own, and 2, to outsource this task to an outside vendor.

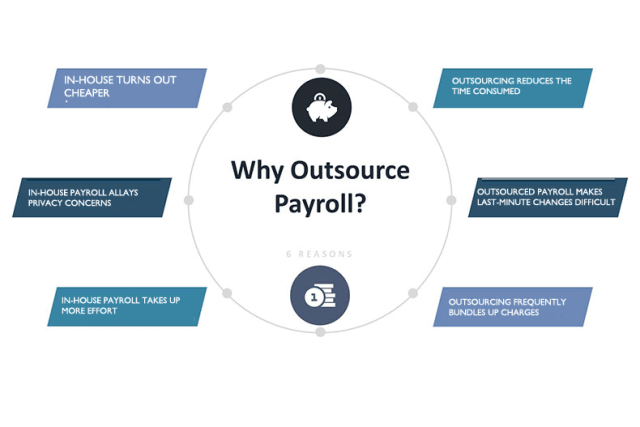

Pros & Cons of In-house vs. Outsourced Payroll

Here are some of the relative advantages and disadvantages of processing payroll on your own as opposed to handing things over to a specialized firm:

1. In-house turns out cheaper

For small and medium-sized businesses, processing payroll in-house is a cheaper option. You can either hire a bookkeeper or use financial software. Online paystub makers like StubCheck.com let you build professional stubs for as little as $3.99 apiece. You can also generate enhanced check stubs with detailed deductions and exemptions as well as create W-2 forms for your workforce.

2. Outsourcing reduces the time consumed

Letting a payroll management firm handle your company’s finances significantly frees your time. The time you previously used for cumbersome tasks like calculating deductions and streamlining tax regulations can be utilized for creative business thinking and new projects. The idea is to spend more time on activities that maximize profit and take your business further.

3. In-house payroll allays privacy concerns

When your payroll is processed within the firm, the employees needn’t be afraid of third parties stealing their confidential wage information. All the critical details on a paycheck stub template rest inside the organization, and employees can access their data whenever required.

4. Outsourced payroll makes last-minute changes difficult

A third-party is likely to have rules limiting the turnaround time, the cut-off date for changes, etc. If you need to account for variable factors like overtime, this might be easier to do in-house. Some firms levy fines and extra charges for edits at the eleventh hour.

5. In-house payroll takes up more effort

Imagine the scenario: you are responsible for your company’s finances. You have to stay updated with any changes in tax requirements. These might occur from time to time in your state or at the federal level. Changes also happen in personnel management. Even if you hire a bookkeeper, the said person will have to be entrusted with a lot of responsibility to create check stub. This is something you must supervise periodically to minimize the risk of scams and monetary frauds.

6. Outsourcing frequently bundles up charges

Many firms offer packages that consist of several payroll-related tasks. While this may seem attractive at first, not all of these will be essential for your business. You might end up paying extra for services you will rarely, if ever, use.

So, What Should You Choose?

While both in-house payroll and outsourcing have their fair share of pros and cons, the latter often turns out to be beneficial in these changing times. As your business grows, it can be difficult to find the time to recruit skilled professionals and supervise their jobs. Investing in expensive financial software and training your personnel on how to make pay check stub online can also be time-consuming. Letting a payroll management firm take over will permit you to concentrate on growth activities. You can also use digital stub generators to build and share payment records with your team.

* * *