Simplified Payroll by Custom Paystub Templates !

The payroll management for an organization is one of the most critical functions that are, however, full of challenges that require wasting a lot of time and resources in assuring wages and compliances with labor laws. Such attention is critical in the payroll management process as it requires meticulousness in calculations and rules. However, the personalized solution of paystub templates has made it easier for businesses to handle this effectively. This article explores ways in which such solutions could simplify payroll, the pros they come with, and their real-world examples, all while integrating relevant data from 2024 to 2025 in the USA.

Te Complexity In-Payroll Management

Payroll management covers much more than issuing paychecks. It includes tracking employee hours correctly, calculating deductions accurately, complying with tax laws, and keeping complete records. Errors in any of these areas may lead to grievous financial discrepancies, employee dissatisfactions, and horrendous legal implications. For instance, around 2.2 million nonfarm payroll jobs were added to the economy in 2024, averaging a net gain of about 186,000 jobs monthly. This further added up to the 3.0 million jobs added during 2023. Such fluctuations highlight the dynamic nature of employment alongside the challenges associated with payroll management.

Simplifying Payroll: Personalized Paystub Template Solutions

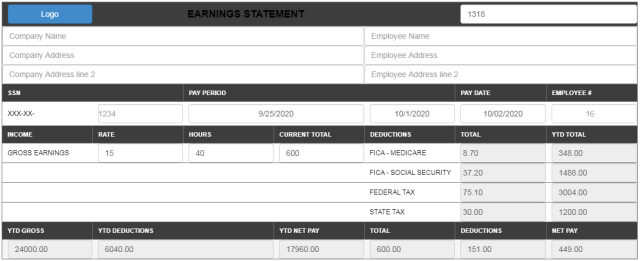

Personalized paystub template solutions are great tools that can help tackle these problems for businesses. They come with a flexible option where an employer can easily and accurately make paystubs professionally. Adding company branding and specific, individualized employee information significantly increases the professionalism of a corporate payroll document. Paystub templates really assist HR and finance departments in standardizing present methods of collecting, sorting, and distributing payments within the improving efficiency

Benefits of Personalized Solutions in Paystub Templates

- Professionalism : Customized paystub templates allow businesses to add their logos, company details, and other personalized information; looking polished and so professional. Not only would that strengthen the company brand, but this does also put the employee at ease by confirming the accuracy and legality of the salary.

- Close to Accurate Calculations : Automated paystub generators bear a lesser risk of manual errors in calculating wages. To ensure precise computations, inputting employee hours, overtime, and deductions into a specified template would make these calculations free of disputes and build a trust relationship between the employer and employee.

- Enhanced Record Keeping : One of the biggest advantages of using a personalized template for paystubs is that afford them accurate data entry for payroll recording purposes. By keeping each documentation of the payroll period, these templates offer organized record keeping that helps for tax filing purposes as well as adherence to labor laws. In that, it also reduces the audit concerns and probability of historical payroll data being accessed by the company for any purposes.

- Cost and Time Efficiency : Payroll processing in the traditional method consumes a lot of time and remains costly, especially for small businesses. Above all, these solutions for paystubs should assure that their work can reduce the manual input required to obtain paychecks specifically and make it quicker. It would bring savings and free up staff to pursue other more important areas of business.

- Labor Law Compliance : An employer has the statutory responsibility to match the compliance of labor laws and tax laws with payroll processing. The specific paystub template can deliver all this requirement in bringing gross earnings, all kinds of deductions, and net pay into its realms, which means it is already among the required formalization for federal and state requirements. Legal issues can then be avoided from any incomplete or wrong nature of pay documentation carried out there.

Real-Life Implementation: A Case Study

Take, for example, a mid-size manufacturing company in Texas that implemented a personalized paystub template solution in early 2024. Earlier, the HR department was involved in manual payroll processing, which was challenging at times and led to errors and dissatisfaction among employees. After the implementation of a paystub template solution, the company started to reap many benefits:

- Reduction in Payroll Errors: The automated calculations minimized errors during the period, resulting in a 25% decline in payroll errors over the period of six months.

- Time Savings: The payroll processing time was also reduced by 30%, thereby allowing HR team members to engage more in employee engagement activities.

- Improved Employee Satisfaction: Clear and accurate paystubs contributed to a 40% reduction in employee inquiries about pay, indicating boosted trust and satisfaction.

This case demonstrates how personalized paystub template solutions can help with common payroll issues and promote efficiency across the business.

Importance of Paycheck Makers in Today’s Payroll

Paycheck makers, commonly referred to as pay stub generators, are online utilities providing the generation of pay stubs using customizable templates. These utilities have grown in popularity due to their easy-to-use interface and the ability to quickly generate accurate pay stubs. By entering basic payroll information, a company can generate professional pay stubs that are in adherence to compliance standards. For example, Stubcheck.com offers a pay stub generation service that helps businesses generate accurate and professional pay stub formats complying with all payroll standards.

Current Trends in U.S. Payroll: Data for 2024-2025 will be discussed.

For effective payroll management, it is crucial to understand the bigger economic context. The U.S. unemployment rate was reported at 4% as of January 2025, a slight dip from the month before. The economy, in January, witnessed the creation of 143,000 nonfarm payroll jobs, a figure that was shy of economists’ expectations but stood nonetheless for growth.

Additionally, wage growth has shown signs of moderation. In 2024, the median pay raise was 4.1%, down from 4.5% in 2023, with projections indicating a further decline to 3.9% in 2025.

Frequently Asked Questions

-

What are custom paystub templates?

Custom paystub templates are pre-made designs that allow businesses to design accurate, professional paystubs for employees, accommodating company details, employee information, earnings, deductions, and other payroll-related information.

-

How do custom paystub templates simplify payroll activities?

The formula takes care of calculations, minimizes errors, and assures uniformity in payroll records. They are a time-saver for businesses through streamlining the generation of paystubs while retaining compliance with tax or labor laws.

-

Are custom paystub templates legal?

Yes, provided the information contained on them proves to be accurate and reflects actual payroll details. It is completely legal to have such templates. Businesses must ensure that they comply with federal and state regulations when creating paystubs.

-

Can small businesses utilize paystub templates?

Absolutely. Small businesses have a hard time affording payroll departments, which makes processing payroll by hand a rather time-consuming job. Custom paystub templates give simple and inexpensive ways of making payrolls fast.

-

Where to get good custom paystub templates?

Many online venues provide personalize paystub templates: payroll software providers and paycheck makers are just a couple of examples. Pick a reputable service that is compliant with tax statutes already.